WELCOME

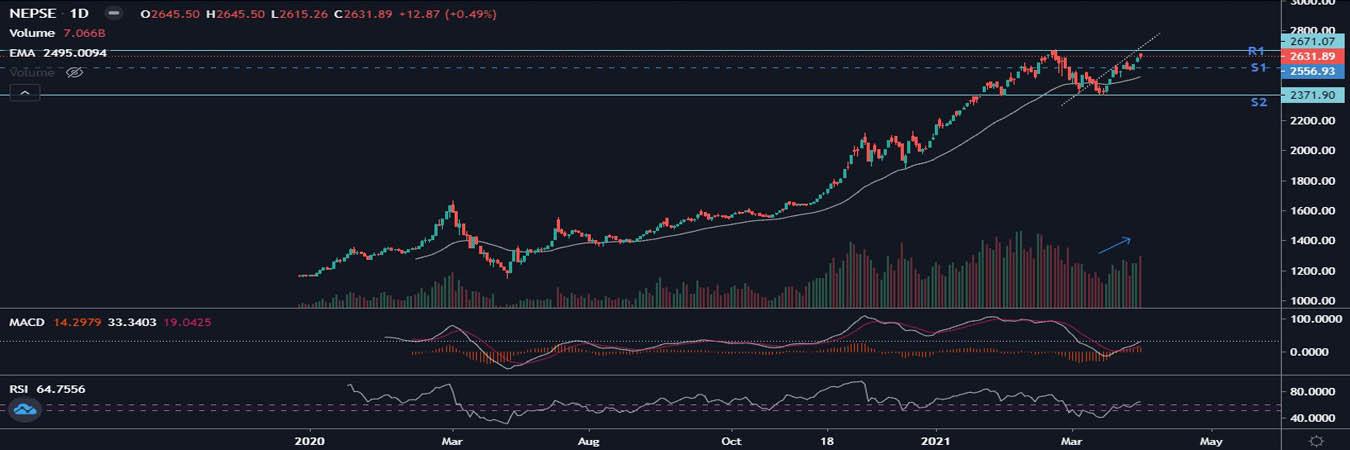

Market Indices

As Of :

Download

News & Notices

-

Prabhu Insurance Company Proposes 9.1579% Dividend for FY 2081/82

2026-03-03

Prabhu Insurance Company Limited (PRIN) has proposed an 9.1579% dividend for the fiscal year 2081/82...

-

IPO for General Public: Shikhar Power Development Limited Issue 1...

2026-03-01

Shikhar Power Development Limited has officially opened its Initial Public Offering (IPO) to th...

-

Super Khudi Hydropower Limited IPO Allotment Concludes: Lucky 1,2...

2026-03-01

Super Khudi Hydropower Limited's IPO allotment was concluded today at the premises of the issue...

-

Kalinchowk Hydropower Limited Closing 82,500 Units IPO Shares to...

2026-03-01

Kalinchowk Hydropower Limited is closing the issue of its IPO for foreign Nepalese Immigrants t...

-

Palpa Cements Industries Limited is opening its 45,00,000 units I...

2026-02-24

Palpa Cements Industries Limited is opening its 45,00,000 units IPO shares to the general...

_(1).jpg)

_(1).jpg)